Mezzanine Finance

What is it?

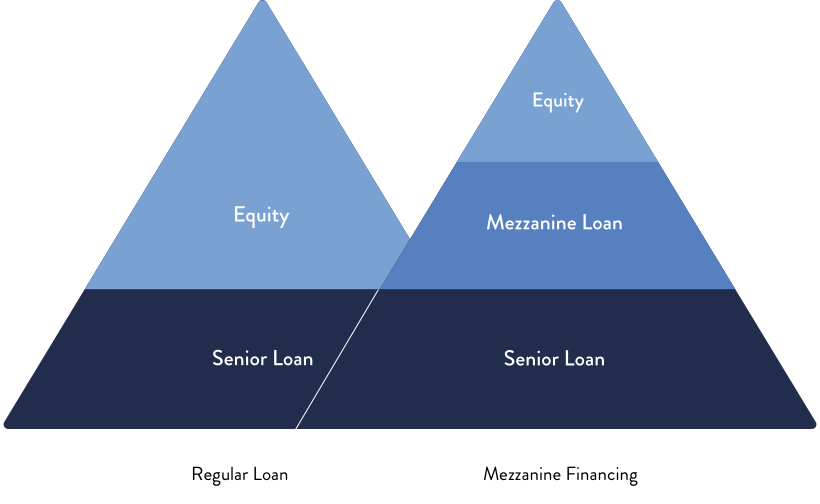

Mezzanine finance is a loan which provides additional debt on a development project in order to reduce the level of equity needing to be put in by the developer.

It is used to top up the development loan from a senior lender with the mezzanine lender, often referred to as the junior lender, lending at a higher day one loan to value (LTV) and loan to cost (LTC). The loan is secured against the development site as a second legal charge with the senior lender having a first legal charge.

It also allows developers to use their saved cash to invest in other projects and further increase their profits.

Why use it?

One key benefit of using mezzanine finance is that it increases the return on investment (ROI) for a developer. This is because the developer puts in less equity themselves whilst only marginally reducing their profit. It also allows developers to use their saved cash to invest in other projects and further increase their profits.

Another benefit of using mezzanine finance is that it is much cheaper than using Joint Venture (JV) funding. Mezzanine finance charges a specified interest rate per annum whereas JV funding is usually compensated via a profit share scheme which is much more expensive. Additionally, the developer will retain full control of their development, without a JV partner having any influence on the project.

Find out more

Bridging Finance

Lending Criteria